Gold has started to rediscover some of its monetary role due to tectonic shifts in geopolitics, which also opens some interesting ways of benefitting host mining communities. Before looking at the potential benefits for host mining communities – first some background about gold’s limited revival in the monetary system, which is being reflected in its recent record prices.

Russia’s invasion of Ukraine saw the former hit by some of the toughest sanctions in history by the latter’s western allies led by the US.

Reserve currencies weaponised

These included freezing around US$300 billion of Russian assets in the West, according to Reuters.

For many nations, particularly in the developing world, this sent a chilling message that the US dollar is now weaponised – that holding their reserves in this and allied currencies, such as the euro, is no longer safe. In other words, falling out with the US could cost you dearly.

China, a US geopolitical peer rival, was particularly disturbed by this move as it holds huge amounts of US assets. Trump being US

President, with his aggressive and unpredictable actions, probably only stirs those concerns.

This is prompting some central banks, particularly in emerging markets, to move more of their reserves into gold and away from US

dollars.

These include the central banks of China, India, Turkey and Poland.

Uncle Sam can’t take your gold

The primary motive for many of them is that if you hold the gold in your own country, it’s much harder for the US to confiscate it. And there are very liquid global markets for gold – much of it outside US control. Indeed, Russia routinely flies gold to different parts of the world to make purchases as it can’t access western payment networks anymore due to sanctions.

Though a lot of the demand for gold has come from central banks – much of it has also come from the private sector.

According to the World Gold Council, gold investment hit a four-year high in 2024, supporting the yellow metal’s 26% annual return with investment totalling 1,180 tonnes worth US$90bn.

Part of that investment demand was reflected in gold exchange traded funds, notably in the second half of the year as US-listed funds attracted inflows. The WGC noted that bar and coin investment was in line with 2023 as gains in India and China offset declines in the US and Europe.

Many of those individual investors are buying gold because they’re worried about the debasement of fiat currencies due to ballooning debts across much of the world.

To be clear I’m not saying gold is going to replace the US dollar or that the world is moving back to a resurrected gold standard. But I do think the steady fragmentation of the global order and the lack of trust between nations is going to increase the importance of gold as a store of value.

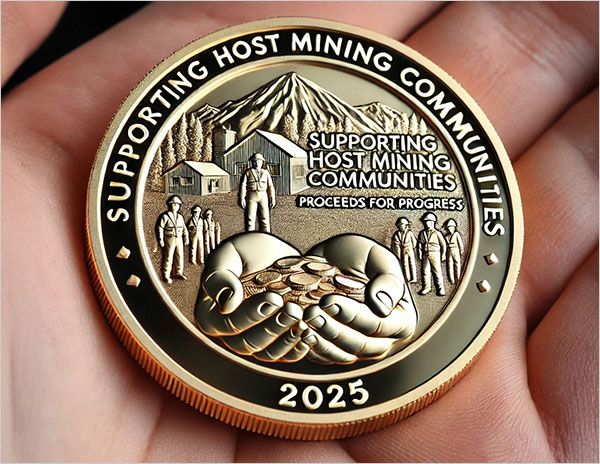

Monetising gold for host communities

Now let's return to host mining communities. Supporting these communities is a core focus of Metals for Humanity. We believe that the characteristics of metals mined near these communities should directly benefit the people who live there.

For example, our Pure Silver Initiative with Fresnillo PLC harnesses silver’s antibacterial properties to provide purified water to residents living near its mines. With zinc we’re exploring using it to enrich diets and with copper we’re looking to make the link with renewable energy and electrification.

Using gold for social good

Unlike the other three metals mentioned – it's difficult to find a direct use for gold in host mining communities. However, it is a powerful symbol of wealth and security and for much of history it sat at the centre of the global monetary system.

It therefore seems appropriate to reflect gold’s economic role in the type of support it can provide to host mining communities.

As such we’re analysing ways in which gold can be used to spur economic activity in these communities, by helping to finance micro-businesses, for example. This could be done by establishing a venture capital fund or backing a micro-lender.

The aim is to make those communities financially self-sustaining long after the mine has closed, so they can maintain social programmes themselves and embark on new enterprises in their continued development.